Red Seal Program Canada Free Download Programs

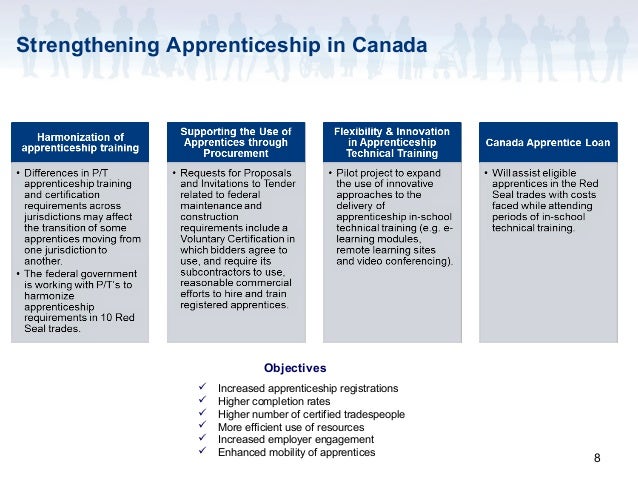

Jan 04, 2021 Another method of Red Seal exam preparation is self-study by accessing the materials offered through the Red Seal program website at www.red-seal.ca. These same materials make up part of the Red Seal exam prep courses at Ashton College and are an essential part of exam preparation no matter how you choose to approach it. The Canadian Council of Directors of Apprenticeship is a partnership between Canada's federal, provincial and territorial governments. It supports the development of skilled trades in Canada and manages the Interprovincial Standards Red Seal Program. It works to harmonize apprenticeship standards across different jurisdictions. The council itself has no powers, but the representatives may.

Why is it worth creating a stamp by us?

Our seal/stamp designer allows you to create seals and stamps of any complexity. The intuitive interface of the designer allows you to create a print layout without having skills in such programs as Corel Draw, Adobe Illustrator, Adobe Photoshop.

We are the first who provided the opportunity to create a layout in vector form. When using vector graphics, the resulting layout allows:

- - To make a seal or stamp on the basis of a model in any way (photopolymer / rubber);

- - Scale the image to any size from 1 pixel to infinity;

- - Has a smaller size when designing complex layouts.

You can download the finished layout of the seal or stamp in different formats:

- - PNG is a bitmap format. The image has a transparent background and a high resolution of 600dpi;

- - SVG is a vector format. SVG vector graphics format allows you to scale the finished layout to any size, as this format is not bypassed in the manufacture of printing by engraving;

- - PDF, a well-known portable document format. This format is supported by all devices, as well as most programs.

- - DOCX to make a easy for your work we added your address stamps to make a great customer service.

The 'Save layout' feature allows you to save your layout. You can go back to editing the layout at any time.

Only our designer allows you to create a round stamp, a triangular stamp and a rectangular stamp.

The federal government has developed an apprenticeship incentive program that pays up to $2,000 as a grant for qualifying apprenticeships. Wood track layout planning software free fast week 8. If you were the beneficiary of such a grant, you need to report it as income on your tax return.

What Is the Apprenticeship Incentive Grant Program?

The Apprenticeship Incentive Grant takes the form of a cash payment of $1,000 per year, up to a maximum of $2,000 per person. To receive it, qualifying apprentices must have successfully finished their first or second year of an apprenticeship program in what is known as the Red Seal trades.

The federal government is now offering AIG-W, this is a grant offered to women to encourage them to enter the apprenticeship programs and get certified in Red Seal Trades. The incentive is cash grant of $3,000 per year up to a maximum of $6,000 if you qualify. Please see this link for more information. And this one to apply.

The Red Seal trades encompass all of the typical trades in fields such as construction, hospitality, the auto industry, and many more. An exhaustive list can be found on the Red Seal Program’s website.

Apprentices can apply online using the Service Canada website. To do so, you will need to provide the following information:

Red Seal Program Canada Free Download Programs For Windows 7

- Your Social Insurance Number (SIN)

- Your provincial apprentice ID number

- The name and phone number of your financial institution along with a voided cheque for direct deposit purposes

- If you reside in Ontario, you will also need to provide complete information about your on-the-job training employer and training institution.

After filling out the application form, you will need to submit to a Service Canada Centre your proof of registration in a designated Red Seal trade program, as well as your proof of progression in the apprenticeship program for the year for which you are applying.

Grant payments and tax slips

- Once the request is processed, payment of the grant is made by direct deposit.

- The grant is taxable, and the apprentice will receive a T4A slip in the mail from the government in February.

- Residents of Quebec will also receive a Relevé 1 slip.

- These slips will be sent to the address you provided when you filled out the application form, and are required to report the income in your tax return.

How Do You Report Grants on Your Taxes?

A T4A slip is used by payers of what is known as “other income” to indicate the amounts that payees have received. Because grants are not employment income in the traditional sense, they are reported as “other income”.

- The amount of your grant will be shown in box 130 of your T4A slip, which also has your name and social insurance number on it. Service Canada will send a copy of the slip to the Canada Revenue Agency, who will match it with your return.

- When filling out your tax return, report the amount on the T4A slip in your income on line 130. On the left side of line 130, there is a space where you should indicate the nature of the income, which is, in this case, an apprenticeship grant.

- Residents of Quebec must also declare the grant as income on their separate provincial income tax returns.

Red Seal Program Canada Free Download Programs For Windows 10

References & Resources